The Virginia foreclosure process timeline is a critical guide for homeowners facing unfortunate foreclosure circumstances. It outlines the step-by-step procedure to navigate this daunting process effectively. In Virginia, the foreclosure process typically begins when a homeowner defaults on mortgage payments, triggering the lender to file a notice of default and initiating the pre-foreclosure period. During this time, homeowners have options such as reinstating the loan by paying the outstanding amount or exploring alternatives like loan modification or refinancing.

However, if the default remains unresolved, the lender proceeds with filing a notice of sale, marking the start of the foreclosure sale process. This notice is published, and a specific date is set for the auction. On the scheduled date, the property is auctioned off to the highest bidder, and if no buyers are found, it becomes bank-owned or “real estate owned” (REO). Throughout this timeline, homeowners can redeem their property by paying the outstanding debt, including any additional costs incurred during foreclosure. Homeowners facing foreclosure must seek legal advice and explore potential options to protect their rights and interests throughout this challenging process. If you want to sell your house for cash in Virginia, it is essential to consider the implications of the foreclosure process and make informed decisions.

Understanding the Basics of the Virginia Foreclosure Process

Understanding the Basics of Virginia Foreclosure Process is essential for homeowners facing the risk of losing their property due to financial difficulties. In Virginia, the foreclosure process follows a specific timeline, which begins when the borrower defaults on their mortgage payments. The lender will then initiate legal proceedings by filing a notice of default, notifying the borrower of their intent to foreclose on the property. This notice is followed by a period known as the pre-foreclosure period, during which the borrower can bring their mortgage payments up to date and avoid foreclosure.

If the borrower fails to do so, the lender will proceed with a foreclosure sale, where the property is sold at a public auction to the highest bidder. Homeowners must understand the various stages of the Virginia foreclosure process and seek professional guidance to explore possible alternatives and protect their rights.

Legal Framework for Foreclosure in Virginia

The legal framework for foreclosure in Virginia is governed by regulations and statutes that outline the process and rights of all parties involved. Virginia follows a non-judicial foreclosure process, meaning the foreclosure can proceed without court involvement if certain conditions are met. The key document in the foreclosure process is the deed of trust, a security instrument that allows the lender to sell the property in the event of default. The deed of trust is recorded in the county where the property is located, providing notice to the public of the lender’s interest in the property.

In Virginia, the foreclosure process typically begins with the lender sending a notice of default to the borrower, informing them of their default, and allowing them to cure it. If the borrower fails to cure the default, the lender can proceed with selling the property through a foreclosure auction. The auction is advertised publicly, and the highest bidder becomes the property’s new owner. It is important to note that Virginia law provides certain protections for borrowers, including the right to redeem the property after the foreclosure sale. This means the borrower has a specified period to pay off the debt and reclaim the property. Virginia law requires that the foreclosure sale be conducted fairly and transparently, ensuring all parties can participate. Understanding the legal framework for foreclosure in Virginia is essential for both borrowers and lenders, as it helps to ensure that the process is carried out under the law and protects the rights of all parties involved.

The Importance of the Notice of Default in Virginia’s Foreclosure

The Notice of Default plays a critical role in the foreclosure process in Virginia. This legal document serves as a formal notification to the borrower that they have defaulted on their mortgage payments, triggering foreclosure proceedings. In Virginia, the foreclosure process timeline is governed by strict regulations, and the Notice of Default is vital in ensuring transparency and fairness.

It allows the borrower to rectify the default by catching up on missed payments or exploring alternatives, such as loan modification or refinancing. The Notice of Default serves as a public record, alerting interested parties, such as potential buyers or investors, about the property’s distressed status. Therefore, understanding the importance of the Notice of Default in Virginia’s foreclosure process is crucial for borrowers, lenders, and the overall integrity of the real estate market.

Other Articles You Might Enjoy

- What Does Pre Foreclosure NOD Mean

- Pre-foreclosure meaning

- Wyoming Foreclosure Process Timeline

- Can Probate Delay Foreclosure

- How Much Less Can You Offer On A Foreclosure

Key Milestones in the Virginia Foreclosure Process Timeline

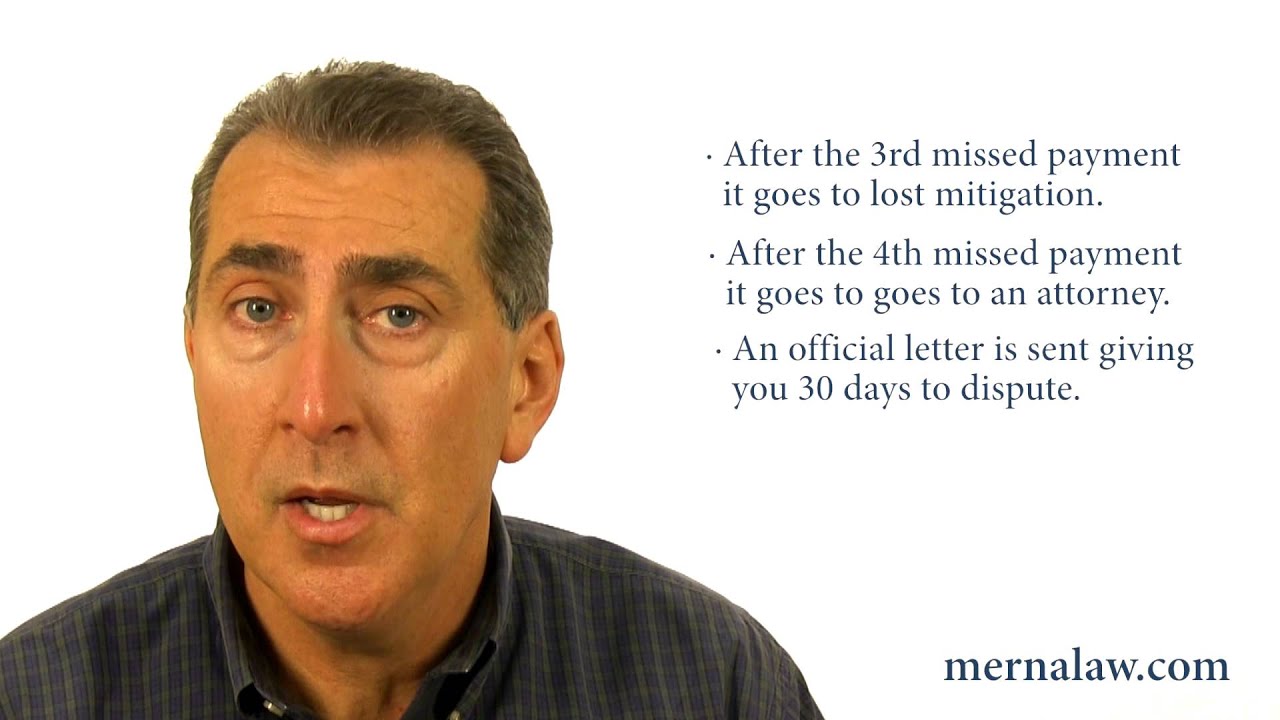

Key Milestones in the Virginia Foreclosure Process Timeline are essential to understand for homeowners facing the possibility of foreclosure. The first milestone is issuing a Notice of Default, typically sent by the lender to the borrower when mortgage payments are missed. This warns that foreclosure proceedings may begin if the payments are not current. The second milestone is filing a Notice of Sale, a public notice that the property will be auctioned. This notice must be published in a local newspaper for a certain period before the sale occurs.

The third milestone is the foreclosure sale, where the property is sold to the highest bidder. This sale is typically conducted by a trustee or sheriff and can be a stressful event for homeowners. The fourth milestone is the redemption period, a specific timeframe for the homeowner to redeem the property by paying off the outstanding debt. Finally, the fifth milestone is the eviction process, which may be necessary if the homeowner does not redeem the property or vacate voluntarily. Homeowners must know these critical milestones to effectively navigate the Virginia Foreclosure Process Timeline.

Default and Pre-Foreclosure Phase in Virginia

Default and the Pre-Foreclosure Phase are crucial in the Virginia Foreclosure Process Timeline. Default occurs when a homeowner fails to make mortgage payments as agreed upon. This can be due to various factors such as financial difficulties, job loss, or unexpected expenses. During this phase, the lender sends a Notice of Default to the homeowner, notifying them of the breach of contract and the impending consequences. If the homeowner does not take appropriate action to rectify the default within a specified period, the Pre-Foreclosure Phase begins.

In this phase, the lender initiates legal proceedings to reclaim the property by filing a Notice of Sale with the county clerk’s office. This notice is a public declaration of the lender’s intention to sell the property at a foreclosure auction. Homeowners in Virginia need to understand the implications of the default and pre-foreclosure phases, as they provide an opportunity to take necessary actions to avoid foreclosure and protect their property rights.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

The Sale and Post-Sale Phase in the Foreclosure Process

The Sale and Post-Sale Phase in the Foreclosure Process is a critical stage within the Virginia Foreclosure Process Timeline. During the Sale Phase, the property is auctioned off to the highest bidder in a public sale. This phase marks the culmination of the foreclosure process, where the lender aims to recoup the outstanding loan balance. The property is typically sold “as-is,” and potential buyers should conduct thorough due diligence before participating in the auction.

Following the Sale Phase, the Post-Sale Phase begins, which involves the transfer of ownership from the defaulting borrower to the winning bidder. This phase requires the completion of necessary paperwork and legal procedures to ensure a smooth transition of ownership rights. It is essential for all parties involved to adhere to the legal requirements and timelines specified in the Virginia Foreclosure Process to avoid any complications or disputes.

How to Prevent Foreclosure in Virginia

If you face the possibility of foreclosure in Virginia, it is essential to take action promptly to prevent the loss of your home. Understanding the Virginia foreclosure process timeline can provide valuable insights into how to safeguard your property. One effective strategy to avoid foreclosure is to communicate openly with your lender. Maintaining an open line of communication allows you to explore options such as loan modification or forbearance, which can help you reduce your monthly mortgage payments and avoid foreclosure. Seeking professional assistance from a housing counselor or attorney specializing in foreclosure prevention can provide you with expert guidance and support throughout this challenging process.

Another proactive step is to review and understand your legal rights as a homeowner in Virginia. Familiarize yourself with the state’s foreclosure laws and regulations, as this knowledge can empower you to make informed decisions and take appropriate action. Finally, it is crucial to create and stick to a realistic budget. By managing your finances efficiently and prioritizing your mortgage payments, you can demonstrate your commitment to resolving the foreclosure situation and potentially negotiate a favorable outcome with your lender. Remember, taking immediate action and seeking professional guidance are vital steps to prevent foreclosure and protect your home in Virginia.

Other Articles You Might Enjoy

- Oregon Foreclosure Process Timeline

- Ohio Foreclosure Process Timeline

- North Dakota Foreclosure Process Timeline

- North Carolina Foreclosure Process Timeline

- New Jersey Foreclosure Process Timeline

Exploring Alternatives to Foreclosure in Virginia

Exploring Alternatives to Foreclosure in Virginia can provide homeowners with viable options to avoid the devastating consequences of losing their homes. Like many other states, Virginia has a foreclosure process timeline that homeowners should know. However, it is essential to understand that foreclosure is not the only solution. By exploring alternatives such as loan modifications, short sales, or deeds instead of foreclosure, Virginia homeowners can find a way to resolve their financial difficulties and protect their homes.

These alternatives may offer a chance to renegotiate loan terms, sell the property at a fair price, or surrender the property without going through foreclosure. Each option has advantages and considerations, and seeking professional advice from experienced professionals in Virginia’s real estate market is crucial to making informed decisions. By taking proactive steps and considering these alternatives, homeowners in Virginia can potentially find a path toward financial stability and avoid the distressing consequences of foreclosure.

Role of Foreclosure Counseling in Virginia

Foreclosure counseling plays a vital role in Virginia, providing essential guidance and support to homeowners facing foreclosure. With its comprehensive range of services, foreclosure counseling aims to assist individuals in understanding the intricacies of the Virginia foreclosure process timeline and empowering them to make informed decisions. These counseling sessions offer valuable advice on legal rights, financial options, and potential alternatives to foreclosure.

By working closely with experienced counselors, homeowners gain a deeper understanding of their situation and develop personalized strategies to navigate the challenges. The role of foreclosure counseling in Virginia cannot be overstated, as it serves as a lifeline for individuals seeking to protect their homes and regain financial stability amidst these trying circumstances.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

Impact and Consequences of Foreclosure in Virginia

Foreclosure significantly impacts homeowners in Virginia, leading to a range of consequences that can have lasting effects on individuals and communities. The foreclosure process in Virginia follows a timeline that starts with the borrower defaulting on their mortgage payments, triggering a series of legal actions by the lender. As the process unfolds, homeowners face the distressing reality of losing their homes and the equity they have built over time. The emotional toll of foreclosure is immense, causing stress, anxiety, and a sense of failure. Financially, the consequences are equally devastating, with credit scores taking a severe hit, making it difficult to secure future loans or find affordable housing options.

Moreover, the ripple effect of foreclosure is felt beyond the individual homeowners; it impacts neighborhoods and communities, leading to declining property values and an increase in vacant properties. As families are uprooted from their homes, the social fabric of communities can be disrupted, leading to a sense of instability and decreased overall well-being. The impact and consequences of foreclosure in Virginia are far-reaching, affecting the individuals directly involved and the broader community.

Financial Implications of Virginia Foreclosure

Foreclosure can have significant financial implications for homeowners in Virginia. When a property goes into foreclosure, the homeowner may face the loss of their investment and potentially owe a deficiency judgment. This judgment represents the difference between the amount owed on the mortgage and the sale price of the foreclosed property.

Foreclosure can negatively impact the homeowner’s credit score, challenging securing future loans or credit. Furthermore, foreclosure can be costly, with legal fees, late payment penalties, and potential eviction expenses adding to the financial burden. Homeowners in Virginia must understand the potential financial consequences of foreclosure and explore alternative options to mitigate these risks.

Social and Psychological Consequences of Foreclosure in Virginia

Foreclosure can have significant social and psychological consequences in Virginia, affecting individuals and communities. From a social perspective, foreclosure often leads to displacement and instability. Families may be forced to leave their homes, disrupting established social networks and community bonds. This dislocation can result in feelings of isolation and loss as individuals struggle to find a sense of belonging in new surroundings. Furthermore, the stigma associated with foreclosure can lead to social exclusion and judgment from others, amplifying the emotional impact of the experience.

On a psychological level, foreclosure can trigger a range of negative emotions, such as stress, anxiety, and depression. The uncertainty and financial strain accompanying the foreclosure process can affect mental well-being, leading to decreased self-esteem and a sense of failure. Moreover, home loss, which is often associated with security and stability, can create a deep understanding of grief and loss. These social and psychological consequences highlight the need for support systems and resources to assist individuals and communities in navigating the foreclosure challenges in Virginia.