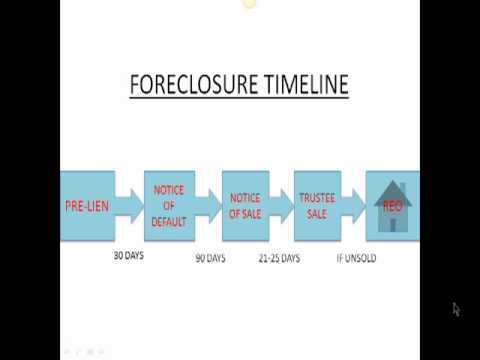

The Missouri foreclosure process timeline outlines the necessary steps in a foreclosure proceeding within the state. For homeowners facing the possibility of foreclosure, understanding this timeline is crucial. It all begins with a missed mortgage payment, which triggers a notice of default from the lender. At this point, the homeowner is given a specific period to either bring the mortgage payments up to date or find a suitable solution with the lender.

However, if no resolution is reached, a notice of sale is issued, clearly stating the date and time of the foreclosure auction. During the auction, the property is sold to the highest bidder. Once the sale is completed, the new owner is entitled to take possession of the property, while the previous homeowner must vacate. It is worth mentioning that the foreclosure process timeline can vary depending on the specific circumstances of each case. Therefore, seeking legal advice and understanding the intricacies of the foreclosure process is vital for Missouri homeowners seeking to sell their homes fast.

Understanding the Basics of the Missouri Foreclosure Process

The process can be complex and time-consuming, requiring a thorough understanding of the legal procedures and timelines. The Missouri Foreclosure Process Timeline provides a step-by-step guide to help individuals navigate the various stages. It begins with the lender issuing a notice of default to the borrower, followed by a period of reinstatement or redemption. If the borrower fails to resolve the default, the lender may proceed with filing a foreclosure lawsuit. This initiates a legal process typically involving court hearings and a final judgment.

Once the judgment is obtained, the property can be sold at a foreclosure auction. Understanding the nuances of the Missouri Foreclosure Process is crucial for borrowers and lenders to protect their interests and make informed decisions.

Defining Foreclosure in Missouri

Defining foreclosure in Missouri refers to the legal process through which a lender takes possession of a property when the borrower fails to make mortgage payments. It is essential to understand the intricacies of this process to navigate the Missouri foreclosure process timeline effectively. Foreclosure can occur for various reasons, such as job loss, medical emergencies, or financial instability. In Missouri, foreclosure proceedings typically begin with a lender filing a lawsuit against the borrower, known as a judicial foreclosure.

This initiates a legal process that involves court hearings and potential auctions. Understanding the specific laws and regulations surrounding foreclosure in Missouri is crucial for homeowners facing financial difficulties and seeking to protect their rights. By comprehending the nuances of foreclosure in Missouri, individuals can explore potential options, including loan modifications or seeking legal counsel, to mitigate the impact of this challenging situation.

The Legal Framework Guiding the Foreclosure Process

The legal framework guiding the foreclosure process is crucial when navigating the Missouri Foreclosure Process Timeline. Understanding this framework’s intricacies is essential for lenders and borrowers involved in foreclosure. In Missouri, the foreclosure process is primarily governed by state laws and regulations, which outline the necessary steps and procedures to be followed. These laws aim to protect the rights and interests of all parties involved, ensuring a fair and transparent process.

Key components of the legal framework include notice requirements, redemption periods, and the role of the courts in overseeing the foreclosure proceedings. By adhering to these guidelines, lenders can lawfully initiate foreclosure actions while borrowers can exercise their rights and explore potential alternatives. Individuals involved in foreclosure must seek legal counsel to fully comprehend the legal framework guiding the process and ensure their rights are protected throughout.

Other Articles You Might Enjoy

- Minnesota Foreclosure Process Timeline

- Illinois Foreclosure Process Timeline

- Idaho Foreclosure Process Timeline

- Hawaii Foreclosure Process Timeline

- Indiana Foreclosure Process Timeline

The Initial Steps in the Missouri Foreclosure Timeline

The initial steps in the Missouri foreclosure timeline involve a series of legal procedures that both the lender and the borrower must follow. These steps are designed to protect the rights of all parties involved and ensure a fair and transparent process.

- The first step is issuing a notice of default, sent to the borrower when they fail to make their mortgage payments on time. This notice informs the borrower of their default and provides a specific period to cure the default by paying the outstanding amount.

- If the borrower fails to cure the default within the given timeframe, the lender may proceed with filing a foreclosure lawsuit. The lawsuit is filed in the county’s circuit court, where the property is located.

- Once the lawsuit is filed, the borrower is served with a copy of the complaint and summons, initiating the legal proceedings. The borrower then has a certain period to respond to the lawsuit and raise any defenses or counterclaims they may have.

- If the borrower fails to respond or does not have a valid defense, the court may enter a default judgment in favor of the lender. This judgment allows the lender to sell the property through a public auction.

- The sale is typically conducted by the sheriff or a court-appointed trustee. The property is sold to the highest bidder, and the proceeds from the sale are used to pay off the outstanding mortgage debt.

- If there are any surplus funds after the debt is satisfied, they are returned to the borrower.

- However, if the sale does not generate enough funds to cover the debt, the lender may seek a deficiency judgment against the borrower for the remaining balance.

Borrowers and lenders must understand these initial steps in the Missouri foreclosure timeline to navigate the process effectively and protect their interests.

Notice of Default and the ‘Right to Cure’

In the Missouri Foreclosure Process Timeline context, it is essential to understand the concept of A Notice of Default, a formal notification sent by a lender to a borrower when the borrower has failed to make timely mortgage payments. This notice serves as a warning that the borrower is in default and that legal action, such as foreclosure, may be initiated if the default is unresolved. On the other hand, the ‘Right to Cure’ refers to the borrower’s opportunity to rectify the default by bringing the loan current within a specified period.

This allows the borrower to avoid foreclosure and regain control of their property. Borrowers must be aware of the Notice of Default and their ‘Right to Cure’ as it allows them to take necessary steps to address the default and prevent the foreclosure process from proceeding. By proactively addressing default issues, borrowers can save their homes and protect their financial well-being.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

The Role of the Trustee in the Initial Foreclosure Steps

The role of the trustee in the initial foreclosure steps is critical in the Missouri foreclosure process timeline. Acting as a fiduciary, the trustee is appointed to oversee the foreclosure proceedings and ensure that the rights of both the lender and the borrower are protected. With a deep understanding of the legal framework surrounding foreclosures, the trustee plays a pivotal role in initiating the foreclosure process by filing the necessary documents with the court.

They are responsible for serving the borrower with the foreclosure notice, also known as a notice of default, outlining the borrower’s rights and the steps they can take to remedy the default. The trustee is responsible for conducting the foreclosure sale, where the property is auctioned off to the highest bidder. Throughout these initial foreclosure steps, the trustee acts as a neutral party, ensuring that the process is carried out by the law and providing transparency for all involved parties.

Navigating the Foreclosure Sale in Missouri

Navigating the foreclosure sale in Missouri can be a complex and challenging process. Understanding the Missouri foreclosure process timeline is crucial to successfully navigating this difficult situation. Several key steps are involved, from the initial notice of default to the final sale. It begins with the lender filing a notice of default, informing the homeowner of their intent to foreclose.

This is followed by a period of redemption, during which the homeowner can reclaim their property by paying off the outstanding debt. If the redemption period expires without resolution, a foreclosure sale is scheduled. At the sale, the property is auctioned off to the highest bidder. Homeowners need to be aware of their rights and options throughout this process. Seeking legal advice and understanding the intricacies of Missouri foreclosure laws can significantly assist in navigating the foreclosure sale successfully.

Other Articles You Might Enjoy

- Iowa Foreclosure Process Timeline

- Georgia Foreclosure Process Timeline

- Alabama Foreclosure Process Timeline

- Connecticut Foreclosure Process Timeline

- Delaware Foreclosure Process Timeline

The Procedure of a Foreclosure Auction

A foreclosure auction is a critical step in the Missouri foreclosure process timeline. The public sale of a property has been seized due to the borrower’s failure to meet their mortgage obligations. The procedure of a foreclosure auction involves several key stages. First, the property is advertised to notify potential buyers of the upcoming auction. Interested parties gather at a designated location, usually a county courthouse or online platform, on a specified date and time. The auctioneer begins by announcing the property’s details and minimum bid requirements.

Bidders can participate by submitting their offers, often in sealed bids or live bidding. Upon meeting the predetermined conditions, the highest bidder is declared the winner and becomes the new owner of the foreclosed property. The procedure of a foreclosure auction may vary slightly depending on each case’s jurisdiction and specific circumstances. Still, the underlying objective remains the same: to facilitate the sale of the property to recover the outstanding debt. It is crucial for prospective buyers to thoroughly understand the procedure and conduct due diligence to make informed decisions during the auction process.

What Happens to the Property Post-Foreclosure Sale

After a property is sold through foreclosure, the ownership of the property undergoes a significant transformation. The post-foreclosure sale process involves several essential steps that determine the fate of the property. Firstly, the property is transferred to the winning bidder or the foreclosing lender. This transfer of ownership is formalized through legal documentation and ensures that the property is no longer under the ownership of the previous homeowner. Following the transfer, the new owner gains full control and possession of the property.

At this point, they may choose to occupy the property themselves or explore other options, such as renting or selling it. The property may sometimes require repairs or renovations to enhance its market value. These improvements can be undertaken by the new owner to attract potential buyers or tenants. Ultimately, the fate of the property post-foreclosure sale rests in the hands of the new owner, who can decide its best utilization based on their circumstances and objectives.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

Post-Foreclosure: Rights of Redemption and Deficiency Judgments

Rights of Redemption and Deficiency Judgments are essential in the Missouri Foreclosure Process Timeline. After a property has been foreclosed upon, the former homeowner may still have the opportunity to redeem the property through a right of redemption. This right allows them to repurchase the property within a specified period, usually after the foreclosure sale. However, it’s crucial to note that the right of redemption is unavailable in all states or under all circumstances.

For instance, Missouri has no statutory right of redemption after a foreclosure sale. As for deficiency judgments, they come into play when the foreclosure sale proceeds do not cover the outstanding mortgage balance. In such cases, the lender may seek a deficiency judgment against the former homeowner for the remaining amount owed. Homeowners facing foreclosure must understand their rights and the potential implications of deficiency judgments to make informed decisions during this challenging process.

Exploring the Right of Redemption in Missouri

Exploring the Right of Redemption in Missouri is essential to the state’s foreclosure process timeline. In Missouri, the right of redemption refers to the legal right of a homeowner to reclaim their property after it has been sold at a foreclosure sale. This right allows homeowners to regain property ownership by reimbursing the purchaser for the total amount paid at the foreclosure sale, plus any additional costs incurred.

The right of redemption in Missouri typically lasts one year from the date of the foreclosure sale, providing homeowners with a window of opportunity to reclaim their property. Homeowners facing foreclosure must understand and explore this right, as it can offer them a chance to regain control of their home and avoid the negative consequences of foreclosure. By examining the right of redemption in Missouri, homeowners can navigate the foreclosure process with more excellent knowledge and potentially find a path toward retaining their property.

Understanding Deficiency Judgments in Foreclosure Cases

Understanding Deficiency Judgments in Foreclosure Cases is crucial to navigating the Missouri Foreclosure Process Timeline. In foreclosure cases, a deficiency judgment occurs when the sale of a foreclosed property does not fully cover the outstanding mortgage debt. This means that the borrower is still responsible for the remaining balance. The understanding of deficiency judgments is essential because it helps homeowners comprehend the potential financial implications they may face even after losing their property.

Sometimes, lenders may pursue deficiency judgments to recover the remaining debt by taking legal action against the borrower. Individuals involved in foreclosure cases need to be aware of their rights and obligations concerning deficiency judgments to make informed decisions and potentially mitigate the impact of such judgments. By understanding the intricacies of deficiency judgments, borrowers can seek legal professionals’ guidance and explore options to protect their financial well-being.