Foreclosure is a legal process that allows a lender to take possession of a property when the borrower fails to make payments on their mortgage. In Virginia, the foreclosure process typically takes around 6-12 months, although it can vary depending on individual circumstances and delays in court proceedings. The first step in the foreclosure process is for the lender to send a notice of default and intent to foreclose after the borrower misses several payments.

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- We Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

Get An Offer On Your Home In 24 Hours!

This notice must be sent at least 30 days before further action can be taken. If no resolution is reached during this time, the lender will file a lawsuit against the borrower, seeking permission from the court to foreclose on their property. Once the court approves an auction date, interested Virginia cash home buyers can bid on purchasing the property through public bidding or selling directly back to your creditor (lender) without going through an auction service like “foreclosures.com.” After this point, you may lose all rights as owner, including access.

The Foreclosure Process in Virginia

Foreclosure is a legal process in Virginia that allows lenders to take ownership of a property when the borrower fails to make mortgage payments. The process can begin after just one missed payment but typically takes several months or years. During this time, the lender must follow strict guidelines and allow borrowers to catch up on their payments through forbearance or loan modification options. However, if these alternatives are not feasible and foreclosure proceedings move forward, it can take 2-12 months for the entire process to be completed in Virginia. This timeline may vary depending on individual circumstances and any delays due to court procedures.

Understanding the Basics of Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments. This can be caused by various factors such as financial hardship, job loss, or overwhelming debt. Understanding the basics of foreclosure is crucial for anyone facing this situation in Virginia.

It involves knowing your rights and options and the potential timeline and consequences of this process. With proper knowledge and guidance, navigating through foreclosure successfully while minimizing its impact on your life and finances is possible.

A Step-by-Step Guide to the Virginia Foreclosure Process

The Virginia foreclosure process can be a daunting and complex experience for homeowners facing financial difficulties. Understanding the steps involved in this process is essential to better equip yourself with knowledge and resources that can help you avoid or delay foreclosure proceedings. First, it’s crucial to note that most foreclosures in Virginia are non-judicial, which means they do not require court approval.

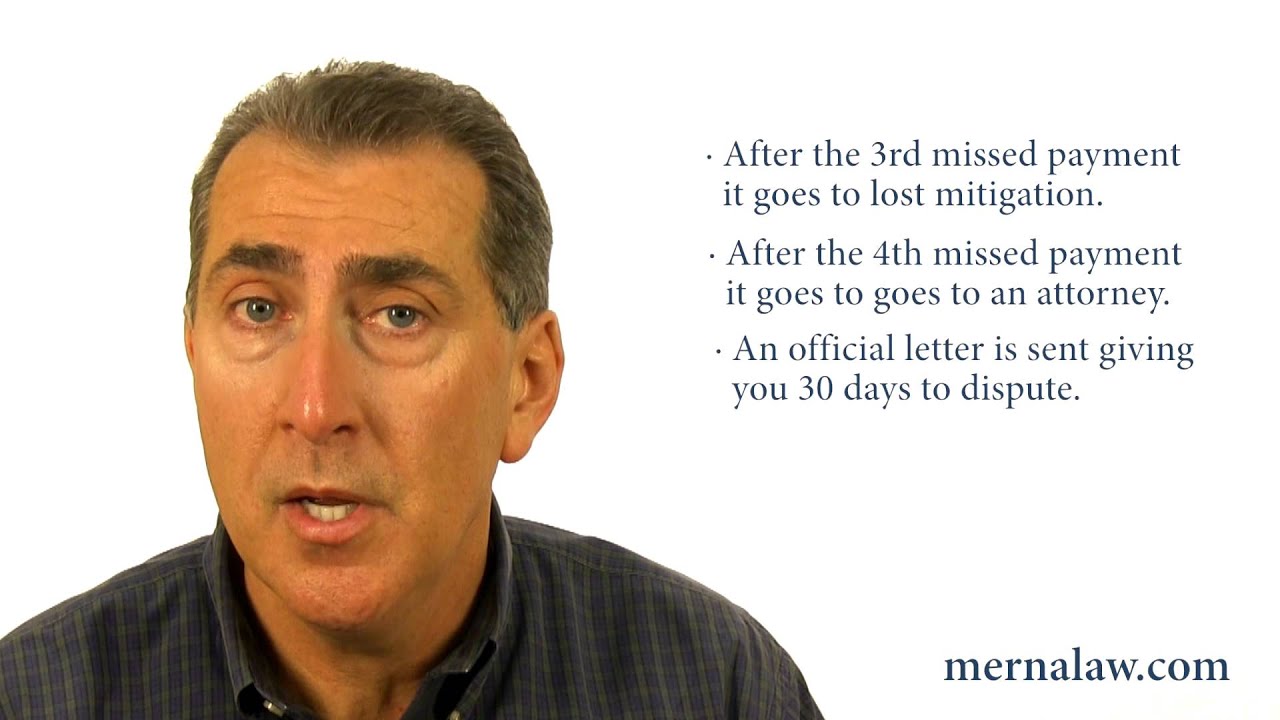

The first step in the process involves receiving a Notice of Default from your lender, usually after missing three consecutive mortgage payments. From there, various stages must be navigated before resolution, including mediation sessions and possible auction dates. Understanding these steps and seeking professional assistance when needed can significantly impact the time foreclosure proceedings occur.

Other Articles You Might Enjoy

- How Long Does Foreclosure Take In Vermont?

- How Long Does Foreclosure Take In Pennsylvania

- How Long Does Foreclosure Take In South Dakota

- How Long Does Foreclosure Take In New York

- How Long Does Foreclosure Take In Oregon

The Timeline of Virginia Foreclosure

The timeline of Virginia Foreclosure is a highly regulated process that begins when a borrower fails to make their mortgage payments. This can occur after just one missed payment and typically leads to the lender sending a Notice of Default, which officially starts the foreclosure proceedings.

From there, the homeowner has 30 days to cure the default or face further legal action from the lender. If no resolution is reached, an auction date will be set for approximately four months later. During this period, known as pre-foreclosure, homeowners have options such as refinancing or selling their home to avoid losing it through foreclosure.

Analyzing the Duration of Each Foreclosure Stage

To gain a deeper understanding of the foreclosure process in Virginia, it is essential to analyze the duration of each stage. This involves examining the time it takes for a property to go through pre-foreclosure, auction, and post-foreclosure stages.

Analyzing this data provides valuable insights into how long homeowners can expect their properties to be in each stage before completion. By carefully studying these durations with semantic and keyword variation phrases incorporated within our research approach, we can uncover patterns that may impact overall timelines for foreclosures in Virginia.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

Legal Aspects of Foreclosure in Virginia

Foreclosure is a legal process in Virginia that allows a lender to seize and sell a property when the borrower fails to make mortgage payments. The first step of foreclosure begins with the lender filing a notice of default, which must be sent to the borrower at least 30 days before initiating further action. Once the borrower has received this notice, they can cure the default within those 30 days or request mediation as provided under Virginia law.

If no resolution can be reached during mediation, then the next step is for the lender to file a complaint and serve it upon all parties involved for them to respond within 21 days. If no defense is raised or settlement made, judgment may be entered and sale proceedings initiated after another three weeks.

Virginia Foreclosure Laws and Regulations

Foreclosure is a legal process by which a lender can repossess and sell a property to recover the unpaid mortgage balance from the borrower. In Virginia, foreclosure laws and regulations are governed by both state and federal law. The timeline for foreclosure proceedings varies depending on whether it is a non-judicial or judicial foreclosure. Non-judicial foreclosures typically take 2-3 months, while judicial foreclosures can take up to 6-12 months.

It’s important to note that homeowners have certain rights during this process, including the right to be notified of any court hearings related to their case. There are strict requirements that lenders must follow throughout the entire foreclosure process for it to be deemed valid under Virginia law.

Other Articles You Might Enjoy

- How Long Does Foreclosure Take In Oklahoma

- How Long Does Foreclosure Take In New Mexico

- How Long Does Foreclosure Take In Ohio

- How Long Does Foreclosure Take In North Dakota

- How Long Does Foreclosure Take In North Carolina

The Rights of Homeowners During Foreclosure

The foreclosure process can be a daunting and overwhelming experience for homeowners in Virginia. However, it is essential to remember that you still have certain rights as a homeowner during this difficult time. These rights include:

- The right to receive proper notification from your lender before legal proceedings are initiated against you.

- The right to challenge the validity of the foreclosure if any discrepancies or errors are found within the documents provided by your lender.

- The right to seek assistance from an experienced attorney who can guide you through this complex process and protect your interests every step of the way.

Homeowners facing foreclosure in Virginia must understand their rights and utilize them effectively to achieve a fair outcome.

Preventing and Recovering from Foreclosure in Virginia

Foreclosure can be a daunting and overwhelming experience for homeowners in Virginia. However, there are steps that individuals can take to prevent foreclosure from occurring or recover if it does happen. One critical step is to seek assistance from HUD-approved housing counseling agencies that can guide budgeting, credit repair, and negotiation with lenders. Staying informed about state-specific laws regarding foreclosure timelines and processes is crucial to understanding the situation.

It’s essential to act quickly when facing potential foreclosure by exploring all options, such as loan modification or refinancing before it’s too late. Seeking legal advice may also benefit those struggling with mortgage payments due to unforeseen circumstances like job loss or medical expenses. Open communication with lenders and proactive measures are essential in preventing or recovering from foreclosure in Virginia.

Call Now (818) 651-8166

Why Sell Your Home to ASAP Cash Offer?

- You Pay Zero Fees

- Close quickly 7-28 days.

- Guaranteed Offer, no waiting.

- No repairs required, sell “AS IS”

- No appraisals or delays.

Exploring Foreclosure Prevention Options

Exploring foreclosure prevention options is crucial for homeowners possibly losing their homes. With the potential of foreclosure looming, it is essential to understand all available avenues and resources to help alleviate this situation.

These options may include refinancing, loan modifications, short sales, or government programs to assist struggling homeowners. Through careful research and consideration of individual circumstances, one can determine the best action to prevent foreclosure and protect one’s home.

Rebuilding Your Credit After Foreclosure

Rebuilding your credit after foreclosure can be daunting, but it is not impossible. Repairing the damage done by a foreclosure on your credit score takes time and effort. However, perseverance and diligence can gradually rebuild your credit standing. One critical step is making timely payments on any remaining debts or loans not included in the foreclosure process.

This will show creditors that you are responsible and capable of managing your finances effectively. Consider applying for secured credit cards or small personal loans to demonstrate accountable borrowing habits. These positive actions over time will help improve your credit score and show lenders that you are taking proactive steps toward rebuilding your financial stability after experiencing a foreclosure in Virginia.